Study: B2B Checkout Report 2024 Summary

The B2B Checkout Report 2024 presents a comprehensive analysis of the current state and performance of e-commerce checkout processes across Europe's top 100 online stores. This study, conducted by Billie, reveals the checkout experiences offered to customers, highlighting significant areas for improvement and opportunities to capitalize on the rapidly growing B2B e-commerce sector. Read on for a summary of the most important findings from the report below.

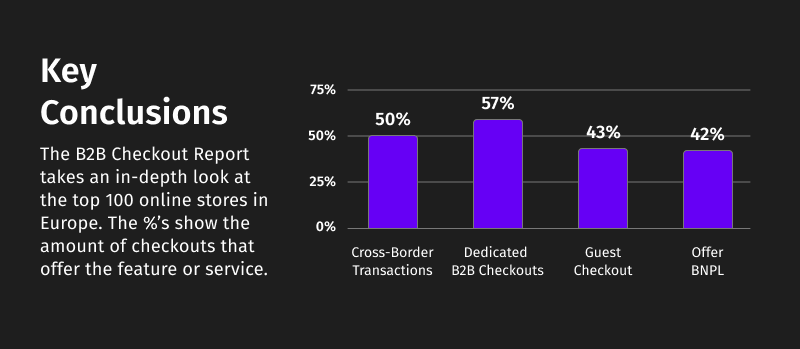

If you’re short on time, here’s the tl;dr version of the key conclusions we were able to draw from the report:

Cross-border transaction limitations: Only 50% of stores allow cross-border transactions, highlighting a significant opportunity in the market.

Lack of dedicated B2B checkouts: 57% of stores do not offer a checkout experience tailored to business customers.

Guest checkouts in short supply: 43% of checkouts do not support guest checkout, meaning buyers have to complete some form of registration before paying.

Payment options available: A number of checkouts are missing key payment methods, with only 42% offering Buy Now, Pay Later (BNPL) options.

For a more in-depth look of the above findings, continue reading.

How EU Regulatory Challenges Hinder B2B Cross-Border Transactions

Despite the European Union's efforts to support a unified digital market, our findings reveal that only half of the e-commerce stores enable cross-border payments. This limitation restricts the market reach for businesses that want to partake in cross-border trade and highlights a key challenge within the B2B sector. However, B2C enjoys regulatory alignment and standardization to support cross-border commerce. This discrepancy presents an opportunity for businesses willing to navigate the complexities of cross-border transactions.

The Opportunity to Stand Out with Dedicated B2B Checkouts

Out of the online stores surveyed, 57% lacked a dedicated B2B checkout, suggesting a significant oversight in catering to the needs of business customers. Having checkouts tailored to B2B helps businesses by accommodating options such as bulk orders, flexible payment terms, and repeat order purchases. Meeting these needs leads to improved customer satisfaction, increased sales, and promotes customer loyalty.

Some Form of Registration is Required for The Majority of Checkouts

Nearly half of the stores examined do not allow guest checkout or the ability to complete purchases without registration. Account creation or sign-up can be a potential blocker for buyers, especially if registration requires a lot of details and verification. The UK, in particular, stands out, with 89% of B2B checkouts requiring some form of sign-up. In contrast, 89% of B2B checkouts in Germany allow guest purchases.

Checkouts Lack Preferred B2B Payment Methods

The number of different payment options available at the checkout is an important factor in the purchasing experience. 55% of European checkouts are short of at least one payment method. The most noticeable is BNPL, with only 42% of checkouts offering this payment method, despite its growing popularity among business buyers. Furthermore, among the B2B stores offering BNPL, only 36% allow purchases above €5000, restricting its appeal due to the typically higher order values in B2B commerce.

Opportunities For Checkouts To Improve The Purchasing Experience

The B2B Checkout Report 2024 sheds light on the current challenges and opportunities within the e-commerce checkout landscape. By addressing the identified gaps, online retailers can improve their checkout processes, ultimately enhancing the customer experience and capturing a larger share of the B2B e-commerce market. The full report offers detailed insights and actionable recommendations for businesses looking to optimize their B2B checkout experience and drive growth.