The Rising Role Of Payments in B2B E-Commerce Growth

This year heralds business-to-business (B2B) e-commerce as one of the largest untapped opportunities in commerce. Shopify recently called out the fact that B2B online retailing is one massive opportunity that’s not spoken about enough. Modern business buyers are moving online, and businesses are investing in online purchasing channels. Making digitization the driving force behind B2B’s momentum. It’s safe to say that the market is beginning to see the rapid expansion that business-to-consumer (B2C) e-commerce saw nearly 20 years ago.

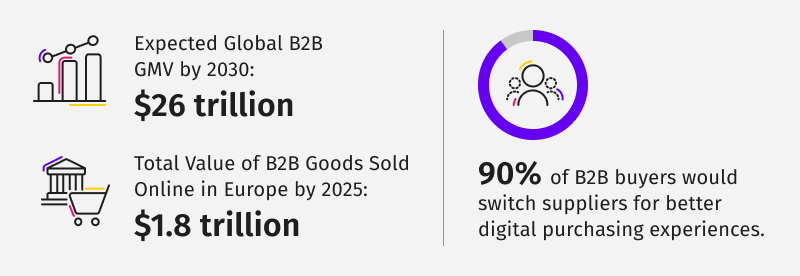

While B2C e-commerce often captures the spotlight, the numbers tell a different story. B2B e-commerce, which is already larger, is set to continue its rapid double-digit growth in the coming years. According to Vantage Market Research, B2B is expected to reach over $26 trillion in global GMV by 2030. Europe also sees substantial growth, with the total value of B2B goods sold online expected to reach $1.8 trillion by 2025.

While the two sectors share similarities, such as focusing on e-commerce and the customer experience, there are multiple differences in their respective value chains. In particular, payments, given the distinct nature of buyer audiences, order management, and transaction value. To be competitive, B2B retailers and brands must pick up the right payment partners to meet the evolving needs of business buyers looking for more digital purchasing experiences. Failure to do so can lead to businesses seeking alternatives. Research shows that 90% of B2B buyers would switch suppliers for better digital purchasing experiences.

Tailoring Payment Methods to B2B Needs

Online retailers entering B2B often start with common B2C payment methods like cards, bank transfers, and digital wallets. However, B2B transactions demand more, exposing retailers to challenges such as the higher costs of card acceptance, unlike in B2C there are no caps on interchange fees for corporate cards in Europe. Additionally other challenges exist such as the limited availability of commercial cards within an organization or restricted bank transfer permissions. The absence of financing or deferred payment options can also strain business buyers' cash flow, with retailers bearing extra costs for offering in-house invoicing solutions.

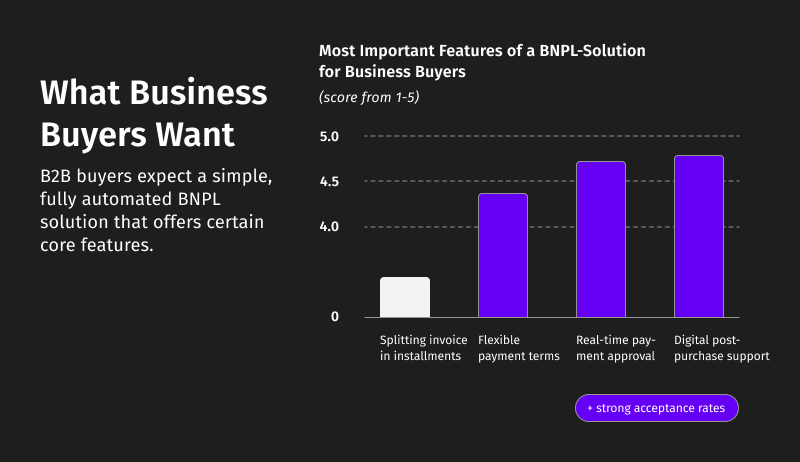

B2B buyers prioritize payment methods that blend simplicity, automation, and cost-effectiveness. While traditional invoicing remains popular, its lack of automation and digitization is a drawback. Conversely, card and digital wallet payments offer ease but raise concerns over costs and availability. This has led to an increased openness towards Buy Now, Pay Later (BNPL) solutions for B2B. This is due to merging the benefits of the widely preferred payment upon invoice and modern digital payment form factors, showcasing a shift in B2B towards more digital and buyer-friendly solutions.

BNPL is gaining traction in B2B for its instant credit acceptance and simplified application process for buyers. This method allows buyers to defer payments, enhancing cash flow and purchasing power. With real-time approval on high order values and features like automated identification, BNPL offers a seamless, modern purchasing experience, meeting the demand for consumer-like payment experiences in B2B.

Scaling Payments Across Borders and Channels

Implementing new payment methods can be a significant undertaking for many businesses. Technical integration is complex and has a knock-on effect on the buyer experience and back-end operational processes. Businesses of all sizes, including online stores and marketplaces are turning to Payment Service Providers (PSPs) to streamline their payment acceptance, enhance processing features, and meet security and regulatory requirements. In addition, PSPs enable the ability to offer a range of payment methods through a single integration, optimizing the payment selection to meet the demands of buyers.

Another complication found in B2B is retailers operating across multiple countries. Different languages, currencies, and regulations further exacerbate already complicated payment acceptance. Cross-border trade is an opportunity that retailers cannot miss. However, accepting cross-border payments in B2B is complex and off-putting for many businesses, which can hinder their expansion and access to potential new buyer bases.

Lastly, retailers expect payment methods to be available across all sales channels. Offering omnichannel purchasing to meet buyers’ payment preferences is becoming the new normal for B2B transactions. Successful B2B payment methods must be accessible at checkout, in-store, and by phone. These factors increase the incentive for online retailers to adopt a single payment stack that offers a truly unified commerce experience.

Billie and Adyen: B2B Payments Engineered for Growth

Adyen, the financial technology platform of choice for leading companies, and Billie, the pioneer in B2B payments, have partnered to offer online stores and marketplaces BNPL payment solutions for B2B. Leading retailers that use Adyen’s fintech platform are already offering Billie to their business buyers.

Merchants globally can integrate Billie via Adyen effortlessly, avoiding re-integration or new contracts. By simply adding BNPL in the Customer Area, they offer a cost-effective, cash flow-friendly payment option for their business buyers. Through its collaboration with Billie, Adyen empowers merchants and their business buyers to overcome common challenges in B2B commerce. This partnership addresses key issues such as optimizing cash flow for both buyers and sellers, reducing the risks of payment defaults and fraud, and streamlining the dunning and collection procedures.

Merchants worldwide, currently operating in the Netherlands, Austria, Germany, and Sweden, now have access to Billie, with plans to expand to the UK, France, Switzerland, and additional countries shortly. Online stores and marketplaces using Adyen can provide Billie's services to their B2B customers in these supported countries, facilitating both domestic and cross-border transactions.