AI-Powered Payments as Fraud Protection in B2B E-Commerce

Business-to-business (B2B) e-commerce is undergoing a digital transformation, with businesses and buyers moving online. 2024 marks the fourth consecutive year sellers are prioritizing online sales channels to take advantage of the B2B e-comm opportunity. Gartner predicts that by the end of 2025, 80% of B2B sales between retailers and buyers will be digital. This shift offers great opportunities but also opens doors to fraud.

After years of focusing on consumer stores, fraudsters are now more and more targeting B2B online stores. Therefore it’s more important than ever for B2B businesses to understand and invest in fraud prevention strategies.

B2B’s Digital Revolution

2020 marked the year that B2B rapidly transformed from what was classically known as a slow and more complex industry. The sudden need for remote selling and buying launched businesses into motion, forcing decades-old processes to change. COVID-19 accelerated business adoption of product and service digitization in European B2B e-commerce markets by seven years.

B2B retailers have gone from barely having an online presence to providing their business buyers with a full-service digital experience. Automation and modern payment methods like Buy Now, Pay Later (BNPL) are becoming more commonplace. Not only has this improved the buyer experience, but it has enabled the European regions to see steady online sales growth, with the total value of goods sold online reaching $1.8 trillion by 2025. However, the industry’s explosive growth has made it an attractive target for fraudsters.

Fraud in B2B — A Growing Problem

Fraud is a growing problem in B2B. Experian’s Defeating Fraud research, highlights that 73% of businesses have seen an increase in fraud losses, with 50% expecting these losses to increase. Hence, B2B retailers need to invest in fraud prevention strategies as they are now more likely to become targeted. Sectors that are particularly at risk are the electronics and construction industries. Owing to the high resale value and transportability of electronic goods, and buyers in the construction sector opting to pay by invoice to cover long, costly projects.

How Fraudsters are Targeting B2B Businesses

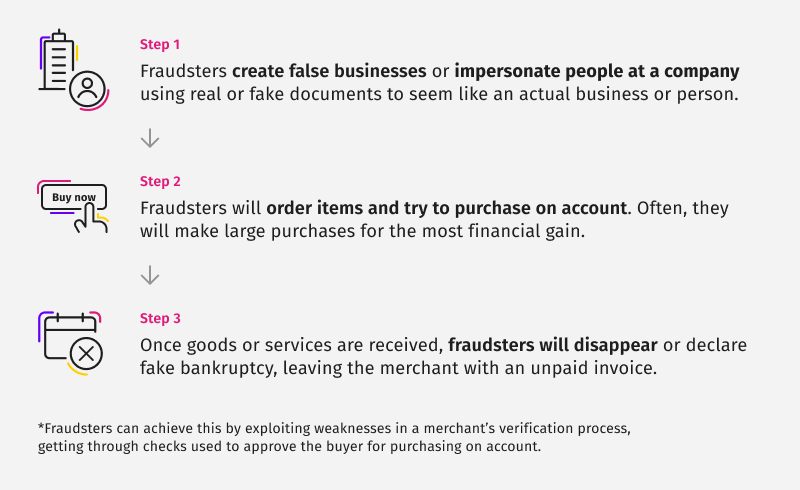

One very common fraud technique used is identity fraud. Which is when fraudsters use false information to impersonate a business or natural person to buy expensive goods or services on account and disappear before ever paying. 46% of online retailers say they have been victims of fraud, with the most common types being related to false identity information and paying at a later date under false pretenses.

Modern Payment Methods As Fraud Prevention

Part of B2B e-commerce digitalization has seen the integration of payment methods that meet the needs of modern business buyers. One such payment method that has seen increased usage is BNPL. Not only do BNPL options enhance the buyer experience by offering flexible payment options, but they also play a pivotal role in fraud prevention.

BNPL solutions, when powered by AI, offer a robust defense mechanism against these threats. These systems aren't just processing transactions; they're actively analyzing purchasing behaviors and detecting anomalies using deep learning techniques. Meaning AI can spot irregular patterns in purchasing, which could indicate fraudulent activity. At the same time, legitimate buyers are still able to purchase, increasing AI’s effectiveness with more data. Additionally, BNPL providers take over full fraud and credit risk, removing a main concern for B2B sellers.

With fraudsters increasingly targeting B2B transactions, the traditional methods of identity verification and credit checks are no longer sufficient. As Natalia Lyarskaya, VP Data Science and Risk at Billie, highlights, the B2B sector is particularly vulnerable to sophisticated fraud schemes, especially those involving false identity information and fraudulent purchases on account.

AI is the New Fraud Battlefield

The battle against fraud is like a chess game, with both fraudsters and defenders leveraging AI. On the one hand, criminals use AI to create fake identities and digital footprints, making fraud detection more challenging. On the other hand, AI-driven BNPL solutions are evolving to stay ahead of these tactics. By constantly learning from past activities and adapting to new patterns, these systems are becoming more adept at predicting and preventing fraud.

While AI excels at identifying anomalies and patterns that might indicate fraud, human insight remains crucial. The combination of AI's analytical power with human intuition and understanding of complex business relationships forms a comprehensive defense strategy. This collaborative intelligence is vital in closing the gaps that AI alone might miss. As businesses start to embrace the digital revolution in B2B e-commerce, it's clear that BNPL solutions, powered by AI, can be powerful tools against fraud.