Payment Methods for B2B Online Stores

Having a selection of different payment methods available in your online store’s checkout is crucial for reducing cart abandonment and increasing conversion rates. The business-to-consumer (B2C) space already offers personal shoppers a wide range of payment methods. And now with Billie, the most popular payment methods are also available in B2B.

Online and offline payment methods are on course for merger

With the rise in online commerce, entrepreneurs are increasingly interested in beneficial innovations in finance. According to a Bitcom study from September 2019, 72% of the companies surveyed saw digitization as an opportunity for their company. Conversely more than 73% of business people considered themselves a bit late to the party. Customers in both the B2C and B2B markets expect a convenient and digital experience for all purchasing actions. Including, and most importantly, an efficient processing of all digital transactions.

What are the payment methods for B2B companies?

For online merchants and their B2B customers, they must ensure their B2B e-commerce payment methods are technically sound. Additionally, the user experience is not to be underestimated. Simplicity is key, particularly for the available payment methods or payment types. Last but not least, high data security in financial transfers is essential.

Payment methods for B2B companies

Direct debit procedure for B2B customers

Prepayment as a payment method for B2B

Instant bank transfer

Credit card payment

Electronic payment provider Paypal

Payment by installments for B2B

Payment by invoice as a B2B payment method

In principle, advance delivery by the seller is advantageous for the B2B customer. After a reasonable period of usually 14 days, the business customer pays the previously agreed purchase price. This payment method is popular among B2B customers due to the associated benefits of this B2B payment method, including fewer order cancellations and a faster ordering process. Payment by invoice requires good risk management to avoid a default on payments as much as possible.

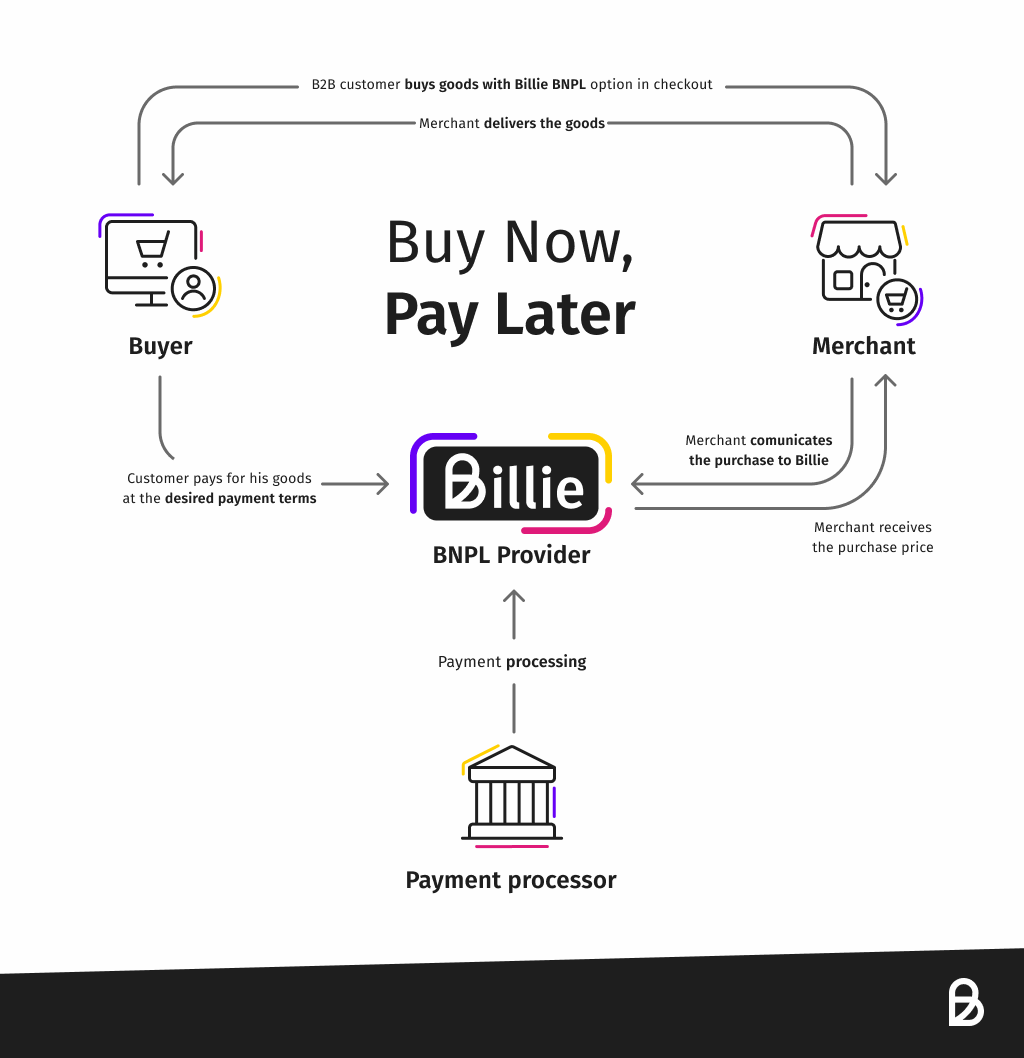

By integrating Billie via Klarna or directly into your B2B online store, your customers are now able to choose from various payment methods and also select any payment term (from 14 to 120 days). Billie takes care of the payment processing, including the identification, credit check and dunning process, so you don't experience any missed payments, while increasing your conversion rate.

Direct debit procedure for B2B customers

In the case of direct debit, B2B buyers have the option of entering their bank details during the ordering process. For the online merchant, a direct debit authorization for the B2B customer's current account is also required. This payment method is especially suitable for the merchants registered regular customers. However, similar to payment by invoice, certain risks arise here due to unsecured debit accounts or an objection on the part of the purchaser. Therefore, efficient management of the risk factors is equally necessary here.

Prepayment as a payment method for B2B

Payment in advance stands out among the payment alternatives for B2B companies due to its low risk for the merchant. This is because the B2B buyer pays by bank transfer from their business account before the delivery is initiated. This payment method is not a favorite with the target group (business customers) because they have to wait longer for goods to be delivered.

Instant bank transfer

The payment options for B2B customers also includes instant bank transfer, the proven online payment service. Business account details do not have to be available to the merchant. Unlike Paypal, no registration is required either. The payment system offered by Sofort GmbH since 2006 works similarly to an advanced payment system. Instead of cashless payment, however, the internet merchant initially receives only an electronic confirmation of the payment transaction that has already been initiated.

Credit card payment

The B2B e-commerce payment method by credit card is included among the most popular payment methods for B2B companies. If a purchase is made by credit card, the online merchant's liquidity is checked beforehand by the credit card provider. This payment method is widely used for international trade.

For cashless payment by credit card, the business customer enters the necessary financial information such as, credit card number, owner's name, expiration date, and the all-important verification code. Using this data, automatic payment in real time is possible. At the same time, the B2B customer's ability to pay can be verified within the electronic system. The extensive features for authentication and liquidity verification, which effectively protect the trader from fraud on the internet, are a huge advantage.

The electronic payment provider PayPal

The service provider for fast, cashless payments provides a digital customer account linked to the B2B customer's credit card or bank account. All electronic payment processes between the buyer and the merchant are handled directly by PayPal. Last, but not least, additional securities are guaranteed for both sides.

Payment by installments for B2B customers

Arranging payment by installments in the B2B area helps to maintain the business relationship. What is essential with this payment method is, above all, sound information and debt management. In this case, the seller can request information from Schufa or the central debtor file before concluding the loan. In particular, such financial companies as KLARNA or PayPal provide favorable installment loans if the creditworthiness of the B2B buyer is available.

B2B payment methods for business customers with Billie

Founded in 2016, our start-up Billie offers modern payment alternatives for B2B companies, including short-term services to stabilize liquidity. Since its inception, Billie has radically revamped the aging system of traditional B2B transactions by enabling B2B entrepreneurs to receive and send payments quickly and easily.

Subscribe to our newsletter to receive updates on new features and financial tips in your email inbox.