B2B Marketplaces convince with Digital Payment Methods

In recent years, online trade with business customers has recorded a strong growth rate, and the trend is continuing. B2B marketplaces, in particular, are experiencing an upswing. To withstand the growing competition, e-commerce platforms should ensure they have a clear competitive advantage. In this article, we explain how B2B marketplaces manage to stand out so that both merchants and buyers choose them.

In an era of digitization, hastened by the global COVID-19 pandemic,e-commerce has become a rapidly growing sales market. Although online trade has been recognized within the business-to-consumer (B2C) market for years, e-commerce in business-to-business (B2B) has been slow on the uptake—until now! B2B e-commerce is in the fast lane and should be closely observed. Marketplaces are especially seeing rapidly increasing numbers. And for B2B marketplaces, it is now more important than ever to keep up with the growing competition, or even better, to stand out.

Over 200% more B2B Marketplaces by 2025

Marketplaces have a wide range of offers from a variety of merchants, providing users a platform to compare different production factors and make a purchasing decision that suits them best. Every day, simple and fast purchasing processes convince millions of B2C customers to purchase via marketplaces. More and more business customers want to see this in their business purchasing. And this trend is making itself felt.

According to IFH Köln, in 2018, B2B marketplaces in Germany generated sales of EUR 27 billion. By 2021, the figure stood at EUR 93 billion, a rise of over 200 % in just three years. While in 2018, 15% of B2B companies sold their goods via marketplaces, this figure had already risen to 27% by 2021. Experts expect these numbers to increase in the coming years, which will result in an increase in demand and supply. There are currently 300 active B2B marketplaces. It is predicted that this number will grow to 1000 by 2025, representing a rise of over 200%.

For marketplaces in B2B to withstand growing competition in the future, it’s important not to ignore these forecasts. The requirements of users are crucial because, ultimately, they are the ones determining which platform they choose to use.

What do B2B Customers expect from a Marketplace?

On the one hand, marketplaces depend on merchants using the sales channel and, on the other, on customers making purchases via the platform. It is important to understand which platform features are relevant for both parties.

These features can differ from sector to sector. However, some are universally expected. Both private and business customers want a smooth and pleasant buying experience. As soon as there is a problem, the purchase is often canceled, and the customer decides in favor of another provider. This is what customers in B2B trade expect:

Pleasant post-purchase experience

Different payment options

The Checkout Process

The old adage - time is money - carries significant importance in business processes. And B2B customers are no exception, as they need fast and smooth purchasing. It is a common enough experience: You’ve filled the shopping cart, selected the payment method, and the checkout process doesn’t work. This leads to abandoned purchases and accounts for a large number of lost sales. To ensure that the checkout process runs smoothly, it must be state-of-the-art, constantly monitored, and optimized.

Post-Purchase Experience

Acquiring new customers is five times more expensive than retaining existing customers (Datasolut, 2021). Therefore, building up a customer base is both sensible and advisable.

To ensure customers buy from a store not just once but repeatedly, attention should be paid to two aspects of the post-purchase process.

One aspect of the process, for example, is customer service. This should be available and helpful. If, after making their purchase, customers don’t feel they get adequate service, they will often not buy from that store again.

In principle, communication with customers should never stop after the purchase has been made.

Another aspect is that buyers expect transparency in the ordering and delivery process. An invoice overview and updates on changes of any kind make companies look trustworthy and professional. This is particularly important in B2B. Therefore, customers are often provided with a tool that gives an overview of orders, changes, and other functions. Customers who experience a pleasant post-purchase process are more likely to make repeat purchases from a store. And conversely, if shoppers have a negative post-purchase experience, they will not hesitate to switch to the competition for future purchasing.

Offer popular Payment Methods

Online retail in B2C provides customers with many conveniences or value-added services. For example, they have the option of selecting their preferred payment method from a range of choices. This has led to B2B customers expecting the same in their business purchasing. If the desired payment method is unavailable, you risk the chance of your business customers switching to another provider. Therefore, it is advisable to integrate the desired payment methods into the checkout.

20% of all users cancel a purchase if their preferred payment method is not available (E-Commerce Payment Report 2021)

Billie's Payment Methods for B2B Marketplaces - Boost sales now

With Billie’s Buy Now, Pay Later (BNPL) payment solutions, such as Payment by invoice or direct debit for B2B marketplaces, merchants can catapult their e-commerce to the front of the competition. With the highest acceptance rate in B2B of over 90%, almost all customers can purchase their goods with Billie. Customers report a 64% increase in conversion rates since integrating with Billie. Additionally, the average order volume is up to 18% higher.

“95% of B2B customers state payment by invoice as their preferred payment method”

As well as being the most popular payment method in B2B, Billie offers many other advantages:

Identification and creditworthiness check in real-time during checkout

The highest acceptance rate in B2B of over 90% for a seamless buying experience

Buyer portal for an optimized post-purchase experience

Includes the entire dunning process to relieve the burden on your own finance department

Real-time Identification and Credit Check with Billie

To protect online merchants from fraud, customers must be identified and their creditworthiness checked before they buy. In B2B e-commerce, this procedure is linked to complex processes. Intricate technical procedures operate behind the scenes for a guaranteed real-time credit check. Billie's scoring algorithm takes on the verification of B2B customers. The API interface is used to verify the customer via the company database. This ensures that customers are legitimate buyers and potential fraud is prevented. Billie assumes full fraud and credit risk.

The highest Acceptance Rate in B2B with Billie

Billie's technical set-up authorizes a wide range of legal forms, including public bodies and sole traders, as well as new customers and guest orders. Thus, Billie enables an acceptance rate of over 90%. And with each identification via Billie, the algorithm learns, increasing performance and risk assessment. Conversely, this means that the acceptance rate continues to rise and purchasing experiences run even more seamlessly.

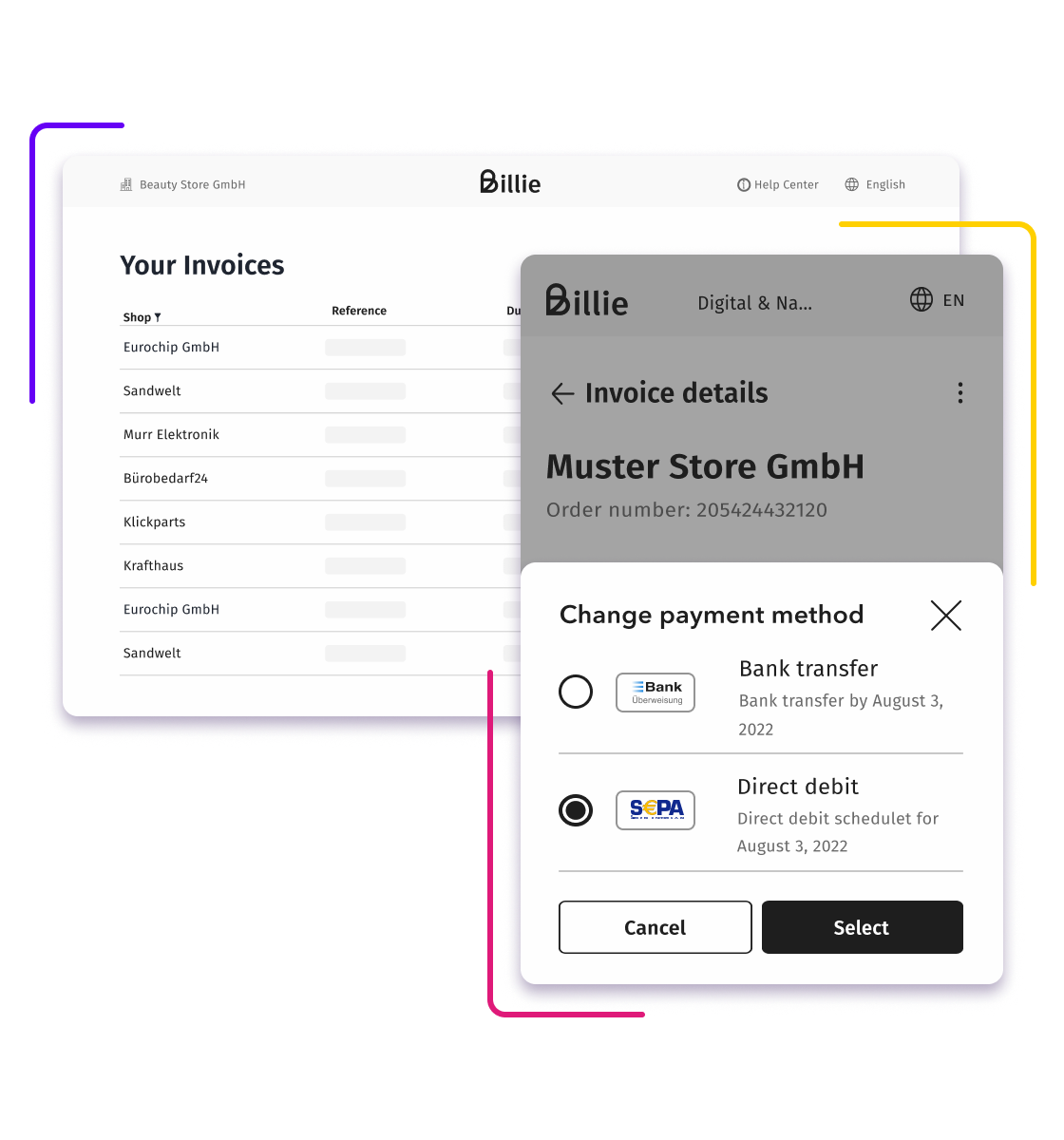

The Billie Buyer Portal

As soon as B2B customers pay with Buy Now, Pay Later via Billie, they receive access to the free Billie Buyer Portal. Meaning, buyers can keep track of their invoices, adjust the payment method as desired and much more. With the optimized post-purchase experience, customers no longer miss deadlines and merchants do not have to deal with payment defaults.

Fully automated Dunning through Billie

If there is a delay in payment, Billie will handle the entire dunning process, including payment reminders and collection procedures. Companies no longer have to deal with the time-consuming process, remain financially liquid, and can fully concentrate on their core business.

“We are convinced that Billie's BNPL solution will help our customers to grow their business.” (Orderchamp, B2B marketplace platform)

The predictions for B2B marketplaces look promising. A strong increase is expected on both demand and supply. Operators of popular platforms now have to prove their competitiveness. In doing so, customers expectations should definitely be prioritized and met. Promising features for a successful B2B marketplace include a functioning technical setup, available customer service and the offer of various digital payment methods.

Do you run a B2B marketplace and want to win your users over with different Buy Now, Pay Later payment solutions? Then speak to our experts directly, or write to us at info@billie.io.