Unpaid Invoices in B2B! What can be done?

If your customer doesn't pay, you should act quickly. This article will provide you with an overview of the various measures and practical tips to prevent the situation in the future.

This is what you'll find in this article:

Your customer doesn't pay the invoice?

Your rights if your customer doesn't pay

Your options if the customer doesn't pay

Try to talk with your customer

Send a payment reminder

Initiate a reminder process

Initiate legal dunning proceedings

Unpaid invoices?

If your customer doesn't pay the invoice, you should lose no time and act quickly. In this article you will find various measures to receive your payment.

When does a default of payment occur?

Default of payment occurs when the due date noted on the invoice has passed and your debtor has not paid the invoice.

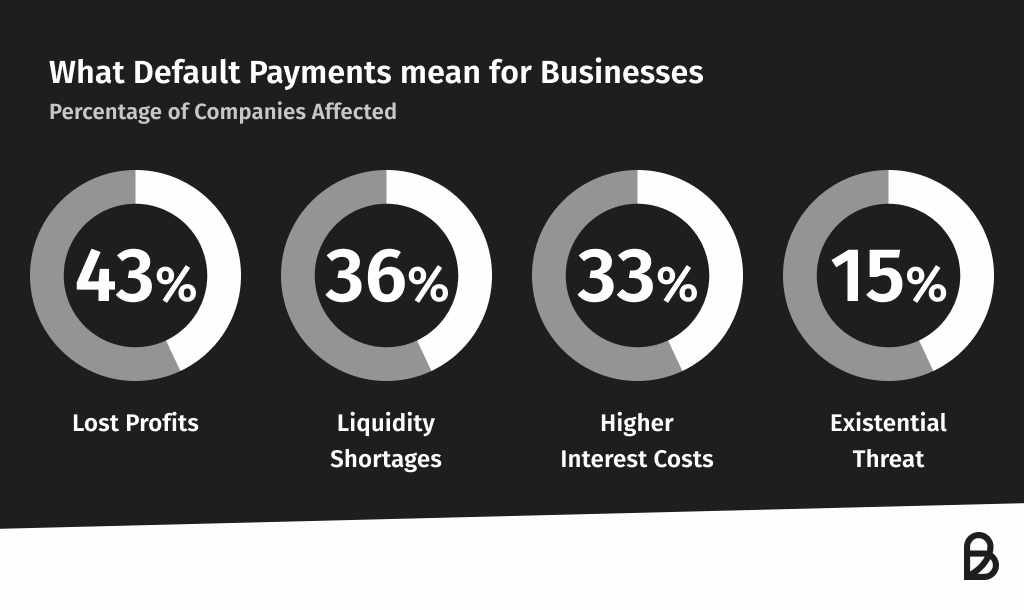

The risk of unpaid invoices?

The biggest risks posed by late payments are lost profits and unstable cash flow, according to a study by EOS,European Payment Practices 2019.

For 15 percent of the companies surveyed, late payments and defaults even represent an existential risk.

So you should act as soon as your debtor falls into arrears. In this case, you as a creditor have various rights and options for action.

What does debtor and creditor mean?

Briefly and concisely: The debtor owes money to the creditor. So if you are reading this article, one of your bills has not been paid yet, you are a creditor and you are waiting for your debtor to pay.

Your rights if your customer doesn't pay:

Once your debtor is in default, you have the right to claim default interest. According to §288 of the Bundesgesetzbuch (German Civil Code), for business customers this is nine percent above the base rate.

You can initiate a dunning procedure. However, you are not required to do so by law.

You can initiate legal dunning proceedings against your debtor.

According to§288 of the German Civil Code, you can claim damages for breach of duty on the part of your debtor.

For the delay, you can charge a flat rate of EUR 40 for business customers.

Your due invoice was not paid?

Your options with unpaid invoices:

Try to talk with your customer

Send a payment reminder

Initiate a reminder process

Initiate legal dunning proceedings

Sell the overdue invoice to a collection agency

File criminal charges against your debtor

Hire a specialized attorney

1. Try to talk with your customer

Your customer may have simply forgotten about the invoice. A short telephone call to remind them of the payment can be sufficient and lead to the payment being received.

As a first step, a short phone call or even an e-mail is highly recommended – after all, a good business relationship is important and should be preserved.

2. Send a payment reminder

If you have not reached your customer by phone or still have not received payment after one week, send a written friendly payment reminder.

You can use the following as a guide for the wording:

“...unfortunately, we have not yet received full payment for your invoice no. XXXX. In the hectic world of day-to-day business, things can easily get lost. It’s likely you just forgot to transfer the amount by xx.xx.xxxx.”

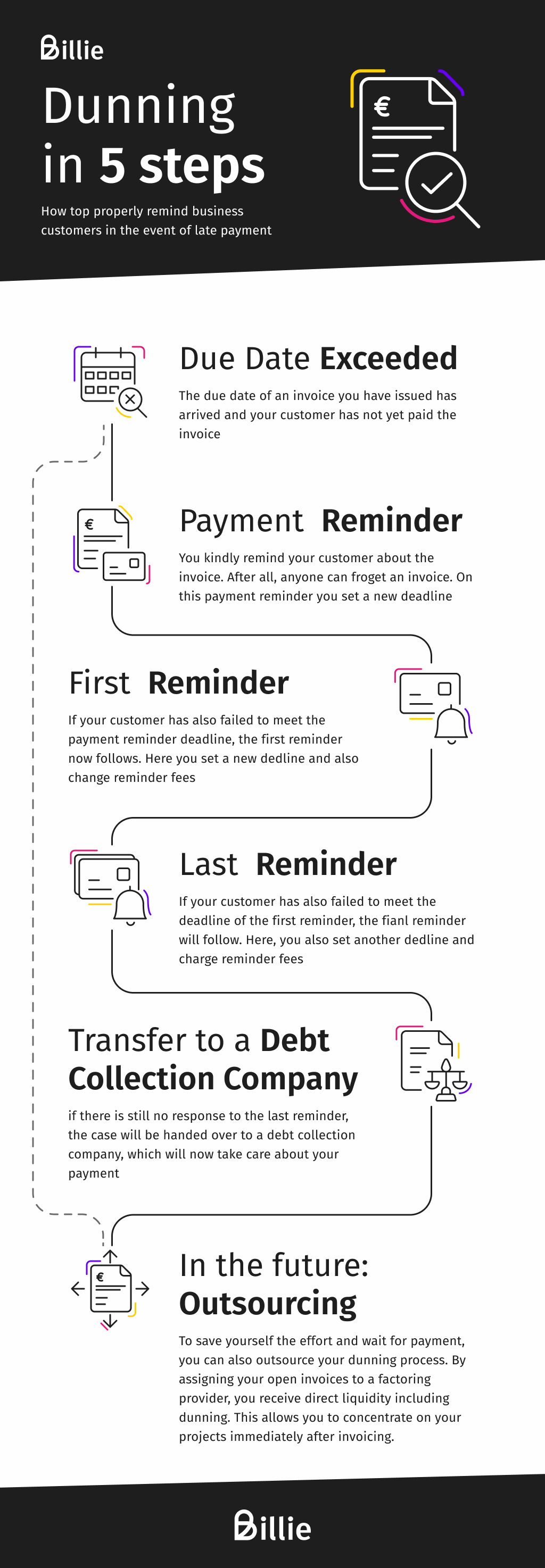

3. Initiate a reminder process

If the written payment reminder was not effective and your customer still has not paid the invoice, you should initiate a dunning process.

As a rule, after a written payment reminder, send up to two reminders before resorting to other measures. However, there is no legal regulation for this – so you are not obliged to do so.

The dunning process usually consists of at least:

A written payment reminder

The first warning

The second warning

A handover letter to a collection agency.

4. Initiate legal dunning proceedings

You have already sent several reminders, but your customer simply doesn't pay? Now it’s becoming a real burden. Now you can initiate ajudicial dunning procedure. The good thing about the judicial dunning procedure is that it is relatively fast and relatively cheap (compared to a lawsuit). You will also delay the statute of limitations for your claims.

Find templates and guides for the dunning process here

4.1 Sell the overdue invoice to a collection company

You can also sell your outstanding and due debt to a collection agency. Collection companies purchase receivables that are due and then collect the money themselves.

This means you have nothing to do with the payment after the sale.

However, it's much cheaper and less time-consuming for you to sell your invoices to a factoring company like Billie right after they're issued – before the due date.

4.2 File criminal charges against your debtor

If the facts are fraudulent, you should file a criminal complaint against your debtor.

This really only applies in the case of fraud. Otherwise, you run the risk of a counterclaim for defamation.

4.3. Hire a specialized attorney

Hiring an attorney is usually quite costly, but it’s someone you can hand over the bureaucratic and operational burden to. So you save a lot of time. If you are spending too much work time on court letters and proceedings, it may be worth hiring an attorney.

How to protect yourself from unpaid invoices

Avoid non-paying customers in the future

If your customer doesn't pay, it's very damaging to you and your business. You may run into financial bottlenecks and it may become difficult to finance the necessary advance payments for new projects. In extreme cases, you may not even be able to pay your employees.

It shouldn’t come to that. Because your business shouldn't depend on your customers' payment habits.

In addition, dunning procedures and court proceedings are a major burden on business relationships.

Check out more helpful guides and tips about your business at